Fisker issued a “going concern” warning.

Financial backers are pulling back severe with Fisker (FSRN – 5.85%) stock today. Portions of the electric vehicle (EV) fire up dove after the organization gave a disturbing “going concern” cautioning in a late night recording yesterday. This basically implies that Fisker is running almost out of money and may battle to proceed with activities.

The organization likewise shared fundamental final quarter profit and reported it was in cutting edge converses with get a venture from a significant automaker, later distinguished as Nissan.

Accordingly, Fisker stock dropped 33.8%, subsequent to falling as much as 47.9% prior in the day. A few misfortunes were recuperated later in the early evening when Reuters detailed Nissan’s contribution.

Fisker under tension

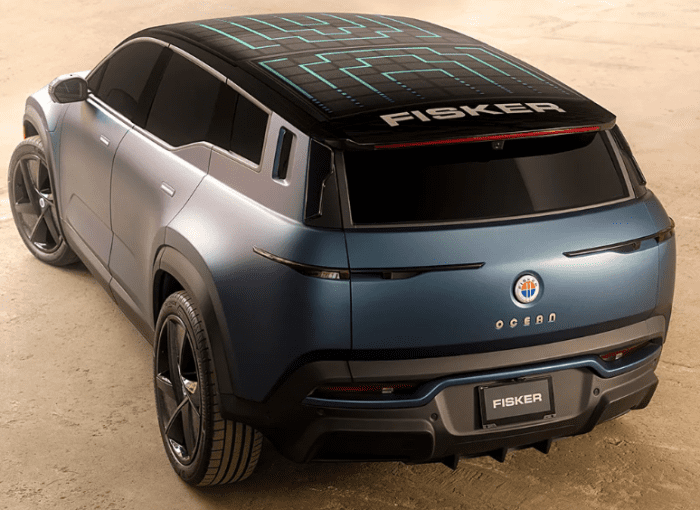

Fisker just began selling its EVs in the second from last quarter of last year, so it has quite recently started producing huge income.

Toward the finish of 2023, Fisker had $395.9 million in real money, cash reciprocals, and limited cash, with $530 million in stock, which incorporates both completed vehicles and unrefined components.

The organization expects capital uses and working capital necessities to diminish in 2024, yet it will probably require new obligation or value supporting to meet its prerequisites over the course of the following a year. Fisker expressed, “The organization hopes to close there is significant uncertainty about its capacity to go on as a going concern” when it documents its yearly fiscal summaries.

Fisker likewise plans to diminish its labor force by 15%, mostly because of its shift to selling through a seller organization. Furthermore, it is in conversations with one of its debtholders about making an interest in the organization.

Might Fisker at any point get by?

Fisker’s issues are not interesting. Numerous EV new businesses, including Clear and Rivian, are encountering huge misfortunes, while additional laid out organizations like Tesla are lessening costs, easing back creation development, and seeing benefits decline.

In this difficult climate, it appears to be far-fetched that Fisker will rapidly turn productive, considerably under ideal conditions. An organization with Nissan could offer some genuinely necessary help and possibly assist Fisker with recuperating, however the chances are as yet overwhelming.

Given the ongoing circumstance, putting resources into Fisker appears to be dangerous.

Would it be advisable for you to put $1,000 in Fisker at the present time?

Prior to purchasing Fisker stock, think about this:

The Diverse Imbecile Stock Counselor investigator group as of late distinguished what they accept are the 10 best stocks for financial backers to purchase now, and Fisker wasn’t one of them. These best 10 stocks could convey significant returns before long.

For example, assuming that you had put $1,000 in Nvidia when it was suggested on April 15, 2005, you’d have $704,612 today!

Stock Counsel gives financial backers a clear outline for progress, remembering direction for building a portfolio, ordinary updates from investigators, and two new stock picks every month. Beginning around 2002, the Stock Guide administration has more than quadrupled the arrival of the S&P 500.

For More Details NCD!